Overview

An AI-based stock market platform that would provide stock price predictions along with automatically pre-processing the data before feeding it to the ML model.

At A Glance

Industry

FinTech

Region

Australia

Duration

12 Weeks

Technical Stack

Client Profile

The client is an Australian-based stock market investing and consulting group, having a firm presence in all parts of Australia and New Zealand. They are now entering the US stock market with their new product of ML prediction.

Challenge

- The client wanted to predict the opening price of the stocks a day before, based on the stock's price fluctuation and other financial data.

- The client also wanted to automate the data collection and pre-processing of the data before running it through the ML algorithm for prediction.

Solution

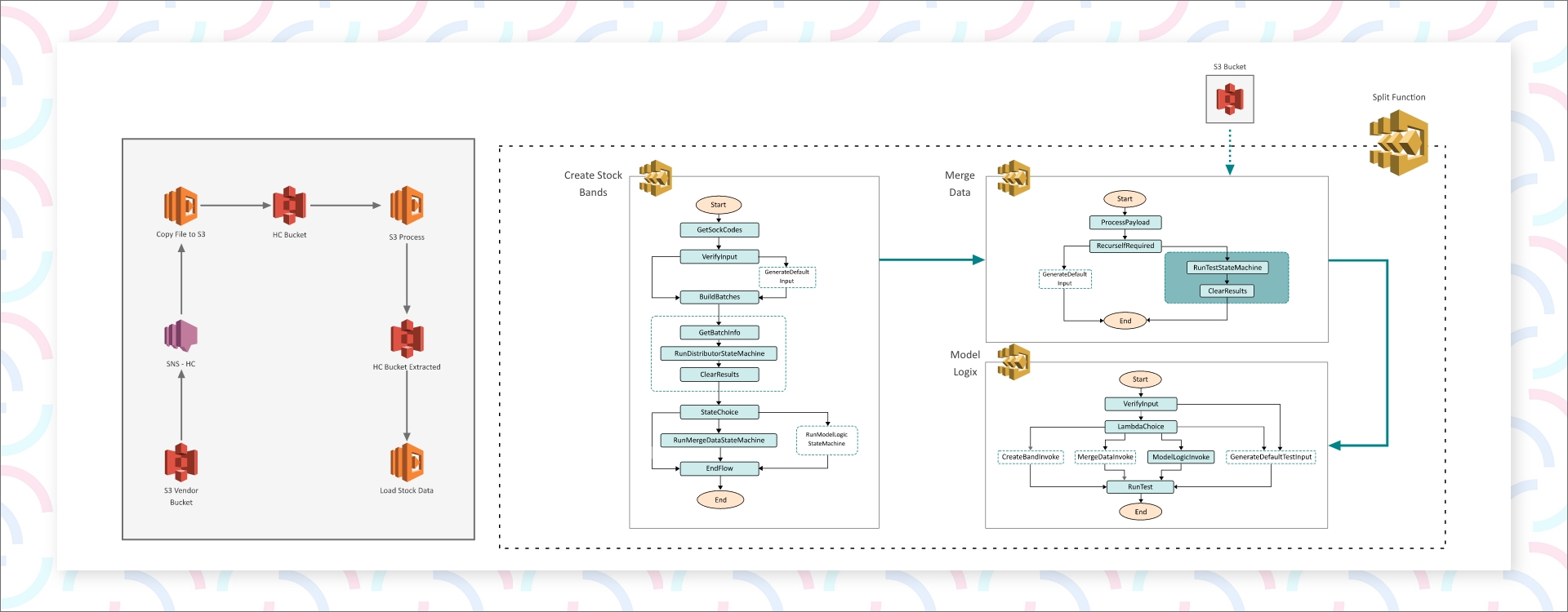

- Seaflux created a serverless framework to accumulate and process the stock market data from the US stock market indexes.

- The serverless framework would automatically fetch and unzip the data to cluster them in prescribed groups. All the data is stored in the Postgres database for analysis.

- The stock data is then pre-processed and cleaned for precise prediction before feeding it to the ML model, trained using the Decision Tree Algorithm. The data consists of the previous market share fluctuations, historical financial data of the stocks, the company's financial records, and other information/news that can impact the stock prices.

- The ML model is trained using the previous data and it keeps on learning with new data added every day. Based on this information fed to the ML model, it predicts the next day's opening stock price with 90% accuracy.

Key Benefits

- 92.7% accuracy to the pricing of the next day stock prices.

- 68% higher subscriptions in the 1st quarter of its launch.

- 43% of the users subscribed to the premium plans at the end of the 2nd quarter.

Develop your next idea with usGet in touch